|

Photo Credit: http://photos.ibibo.com/photo/1420483/canon-d-autorickshaw-bangalore-india |

Circa - Summer of 2006. We were on our way back from Inox Adlabs, Wadala after disappointedly watching The Da Vinci Code. A little ahead of the theatre, towards the highway, we crossed what was going to be my first work place after my MBA. That got us to discussing the vagaries of my travel to Credit Analysis & Research (CARE) Ltd, which was oddly located on the Eastern Express highway, a little before Chembur. Mayuri (fondly referred to as MJ), in her usual candid manner, poped out with a suggestion: “Teja, why don’t u consider buying an autorickshaw and leasing it? That way you can travel to and fro work for free, and also earn rentals!!” Laughter burst immediately, but little did any one think of the economics of MJ’s idea.

Back to 2011 – around the first rains of the season. There exists an unusual relation between rains, potholes and autorickshaws in Mumbai. Inadvertently, with each passing rain, the number of potholes in Mumbai increases at an exponential rate, no matter how often they are repaired. Similarly, one wild shower can cause most autorickshaws to breakdown, irrespective of its age. Surprisingly, no manufacturer has paid any attention to this crucial detail – maybe in next meeting I’ll point this out to them.

In case you are wondering if I have changed my mind about the blog title from ‘economics of…’ to ‘distress of…’ - not just yet; hang on. The reason I ramble about these issues that, had it been for them, then I would not have yet completely understood the economics of autorickshaws. So, getting back to the story, somewhere around the ascent of this year’s monsoon, I was stranded on my way home in a broken-down autorickshaw. Out of curiosity (an-analytical-mind, afterall!!), I initiated a conversation with the driver as to why these autorickshaws break down. As the downpour gained momentum, our conversation drifted from the problems to the finances, and revelations happened.

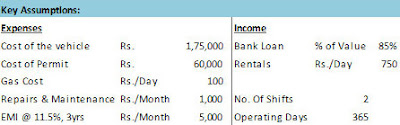

Being an analyst, I simply couldn’t resist the temptation of running the numbers on an excel sheet and calculating the IRR (Read more on IRR here). While my first calculations stunned me, I later realised my folly. Nevertheless, I thought this would be an interesting post, and hence here it is. Lets first start with the assumptions:

|

| (c) ananalyticalmind.blogspot.com |

These assumptions are mostly what came out from my conversation with the driver, although I have back-tested some of the data for verification. Since most of the variables are self explanatory, I will not get into specifics/detailing. Equipped with this data, I started working on the cash flows. The following is what transpired out of my first attempt:

|

| (c) analyticalmind.blogspot.com |

Whoa!!! Can you believe this? An IRR of 186% from running an autorickshaw? If generating returns was so simple, why is the world running behind complex financial derivatives? All this talk of asset allocation, efficient frontier, diversification etc, was it all just theory? Is money making so simple in practise? Definitely not!! If this was true, wouldn’t everyone in the world be owning/driving autorickshaws? And so I pondered over what could have I missed? Well, a basic but important data point: the driver’s salary! So then here is what happens once you consider the driver’s expenses:

|

| (c) ananalyticalmind.blogspot.com |

Still over 100%? If this is true then why is it that we do not see enough autos on the road? Why is it that every morning and evening people run behind these three-wheeled-money-making –machines pleading to be taken to their offices/homes? There has to be some catch; and there is. Most auto drivers hail from villages and have big families to take care of there. And so, while their expenses are not very high, they save a higher amount for the family. A few more conversations with other auto drivers over the next couple of weeks, and the file was updated as follows:

|

| (c) ananalyticalmind.blogspot.com |

Yes, now that is more reasonable, more like it. While to a lot of us glorified MBAs this return may seem paltry, lets not forget the following:

- For most of the people hailing from villages, life is mostly about hand-to-mouth existence,

- Neither do these people have pan cards, nor do they pay taxes i.e. this is a PTRR (post tax rate of return),

- The cash-flows above assume only four years of operations, whereas typically autos as old as 8-10yrs old as ply on the road,

- As the years progress, the cash flows increase as most of the fixed costs reduce (although maintenance costs increase), thus enabling investments into second/third vehicles.

But then, one may wonder, if it is so profitable, then why don’t we see an over-supply of autos? Well, that’s because of a small entry in the cash flow above, the ‘permit’. These permits are issued by the Government, and there is a limit to the cumulative number of permits existing at any time. This keeps a check on an market dynamics, putting the autorickshaw owners at an advantage. Also, it seems that why a lot of permits have expired recently, the Government hasn’t issued any new permits.

Now you know why you have to beg to be taken places? Maybe its time you considered a smart investment ;)

2 comments:

Very interesting analysis Tejas.

Thanks buddy....

this is another interesting read on similar topic....shared by a friend...

http://www.worldandi.com/subscribers/feature_detail.asp?num=26743

Post a Comment